Hey, it's Niru.

In today's issue:

Why Santander's "calculated retreat" from Ferrari might be the smartest F1 move in years

How Crypto.com's $100M bet reveals the real cost of customer acquisition at scale

The activation strategies that actually drive revenue (and the ones that just drive noise)

4 lessons every commercial leader can steal from this financial services face-off

And more…

Your turn: Scroll down after reading to vote on what you thought of this week's issue and let me know what you want to dive deeper into next. The only way this newsletter can improve is through your feedback. If it has helped you think differently about partnerships, please share it with someone who needs to see it.

Let's Partner

Connect with the commercial leaders who orchestrate million-dollar partnerships at Fortune 500 brands and major sports properties. Let's talk.

DEEP DIVE: Santander vs Crypto.com

When Old Money Meets New Tech at 200 MPH

A 167-year-old Spanish bank that once financed explorers searching for the New World is now battling a 5-year-old cryptocurrency platform for the hearts, minds, and wallets of Formula 1 fans. Both are selling the same thing, financial services, but their approaches couldn't be more different.

While Santander was quietly ending its $60 million-per-year Ferrari partnership after three years, Crypto.com was doubling down with a $100 million extension through 2030. One brand is retreating to regroup; the other is betting the farm on F1's future.

The real question is: Who's actually making money from these deals?

Why This Battle Matters

F1 teams generated $2.04 billion in sponsorship revenue in 2024, with the entire sport commanding over $2.9 billion in sponsorship spend. For financial services companies, F1 represents the holy grail: a global, premium audience with disposable income.

But you can’t just show up and hope for the best.

The Contenders

Santander: The Banking Behemoth

€1.3 trillion in total funds, 168 million customers, 8,300 branches

A decade-long relationship with Ferrari (2010-2017, 2021-2024), now pivoting to Williams Racing

Traditional brand building with a focus on established markets

Crypto.com: The Digital Disruptor

Founded in 2016, grew to 80+ million users by 2024

Official global sponsor since 2021, title sponsor of Miami Grand Prix through 2041

Aggressive customer acquisition through high-visibility partnerships

The Strategic Showdown

Santander's "Calculated Retreat" Strategy

After paying $60 million annually for Ferrari's front-of-house visibility, Santander realised that being on the fastest car doesn't always mean you're winning the race.

Their new approach is smarter, not smaller:

Diversified Investment: Spreading risk across the Williams Racing partnership and official F1 retail banking status. Especially with UniCredit joining Ferrari, there is less competition.

Market-Specific Targeting: Using F1's global reach to reinforce visibility in their "main markets.”

Openbank Integration: Promoting their digital banking subsidiary as a direct response to fintech competition.

The Revenue Reality: Santander's strategy focuses on customer retention and premium brand positioning rather than massive user acquisition.

Crypto.com's "Go Big or Go Home" Gambit

Their $100 million commitment through 2030, plus Miami Grand Prix naming rights through 2041, represents the largest crypto sports marketing bet in history.

Their activation strategy is textbook digital-first:

Title Sponsorship Premium: "Formula 1 Crypto.com Miami Grand Prix" naming rights create unavoidable brand exposure.

Fan Experience Integration: Crypto.com Terrace and campus activations create tangible touchpoints.

Digital-First Engagement: Leveraging F1's young, tech-savvy audience for direct customer acquisition.

The Revenue Reality: Crypto.com's strategy is focused on pure customer acquisition at scale, betting that F1's global reach will justify the massive upfront investment.

The Activation Analysis

Santander's Strengths:

Digital Integration Excellence: @formulasantander demonstrates a refined understanding of F1 culture.

Cultural Authenticity: Activations feel genuinely integrated with F1 culture.

Cross-Selling Potential: F1 partnership supports a broader financial services ecosystem.

Crypto.com's Strengths:

High-Visibility Positioning: Title sponsorship creates unavoidable brand exposure.

Global Reach: Can serve customers worldwide without geographic banking limitations.

Financial Resources: Ability to outspend competitors for premium positioning.

Key Weaknesses:

Santander: Geographic limitations and product complexity.

Crypto.com: Superficial integration and regulatory uncertainty

The Competitive Landscape: Who's Winning and Why

Current Scoreboard:

Brand Integration: Santander leads through authentic F1 community engagement and cultural understanding.

Digital Activation: Santander's @formulasantander approach shows superior fan engagement and cultural integration.

Customer Acquisition: Santander's targeted, relationship-based approach proves more effective than Crypto.com's broad visibility.

Long-term Sustainability: Santander's honest fan engagement creates more sustainable competitive advantages.

The Unexpected Winner: Williams Racing. By partnering with Santander while maintaining independence, Williams has created a template for teams to maximise sponsor value without compromising long-term flexibility.

The Revenue Reality: What We Actually Know vs. What We Can Estimate.

Neither company publicly discloses specific revenue impact metrics. However, we can use industry benchmarks:

What We Know for Certain:

Crypto.com reports approaching 100 million users in 2024, up from 80 million in 2023

Industry Benchmarks:

Banking customers generate $200-$ 1,500 in annual revenue per customer.

Fintech platforms typically generate $50-400 annually per active user.

Sports sponsorship ROI studies show successful partnerships achieve 2-5x returns over 3-7 years.

Important Note: Without access to internal company performance data, specific revenue attribution remains largely speculative. These estimates are based on industry benchmarks and publicly available studies on sponsorship effectiveness, rather than verified company metrics.

Both approaches appear to generate positive returns, but for different reasons. Santander uses F1 for brand building that supports broader financial services sales across multiple product categories. As stated by their own records, Openbank by Santander reached 100,000 customers in the United States.

Crypto.com hasn’t faded away. It’s still a leading player. Business Insider calls it the “Best for Mobile Traders,” giving it a 4.35/5 score. Its app, loved by users, has a 4.7/5 rating on the Apple Store (iOS) and 4.1/5 on Google Play. Investopedia praises it as the “Best for Mobile App” and “Best for Bitcoin.” With over 400 cryptocurrencies and advanced trading options, it’s holding its own.

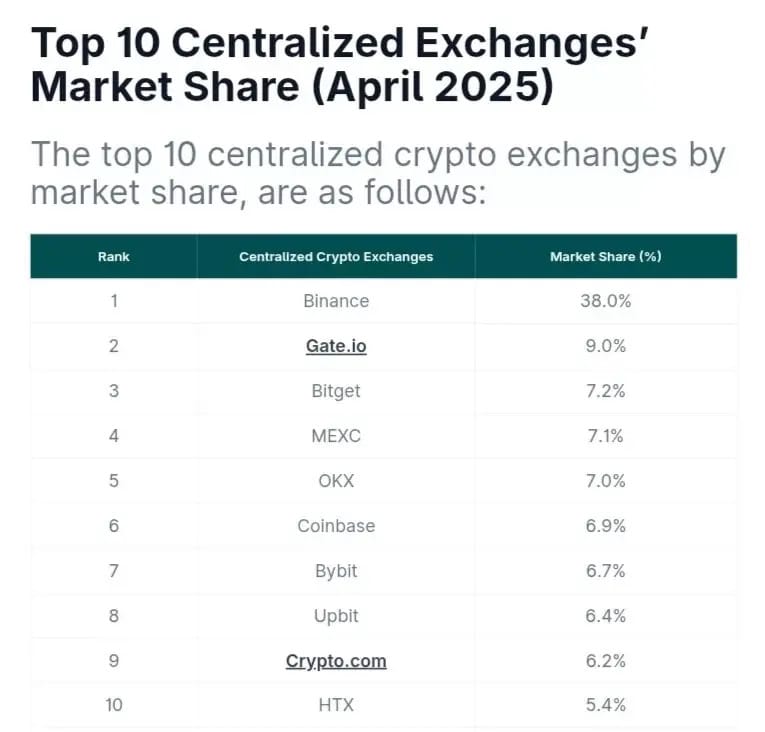

But the market has been tough. Recent data from CoinGecko reveals a notable decline in Crypto.com’s market presence. In April this year, the exchange held a 6.2% market share, ranking 9th among CEXes, a huge drop from its earlier standing. This decline is further underscored by a 26.1% decrease in trading volume during the first quarter of 2025, as detailed in the same report.

Source: CoinGecko

Based on their approach in 2025, they have shifted their approach to win users through their experience, not noise. However, I don’t see that translated through their partnerships. Perhaps something to look for in the future.

I prefer the Santander approach because they chose the depth option (3Cs: Connection, Conversation, Curiosity) over the width option (likes, impressions).

The Big Picture: What This Means for the Future

The Santander vs. Crypto.com battle represents more than just two brands competing for attention. It's a case study in how traditional industries and digital disruptors approach customer acquisition in premium environments.

The Broader Implications:

Sports Marketing Evolution: F1 partnerships are becoming more data-driven and ROI-focused.

Financial Services Competition: Traditional banks must compete with fintech on experience, not just stability.

Global Brand Building: F1's international reach makes it ideal for brands with global ambitions.

What You Should Do Next

If You're a Brand Marketer:

Audit your current sponsorship portfolio for activation opportunities.

Consider how digital-first approaches might enhance traditional partnerships.

Develop metrics that track customer lifetime value, not just awareness.

If You're in Financial Services:

Study how fintech companies are using sports marketing for customer acquisition

Consider how traditional brand building can support digital transformation efforts

Explore partnership opportunities that combine stability with innovation

The Ultimate Question

As F1 continues to grow and evolve, which approach will prove more sustainable, Santander's calculated brand building or Crypto.com's aggressive customer acquisition?

My answer is Santander IMO.

Before you go: Here are 3 ways I can help you:

1) Executive Ghostwriting & Thought Leadership I help CCOs, CMOs, and founders craft powerful communications, whether it's speeches, op-eds, LinkedIn posts, or that next big keynote. Let's turn your expertise into influence.

2) Strategic Communications Consulting: From crisis communications to brand storytelling, I partner with commercial leaders to build trust, drive growth, and ensure your message resonates with the audiences that matter most.

3) Speaking & Content: Book me for keynotes, panels, or custom content on the business of sport, media, and commercial innovation. Let's bring fresh, actionable insights to your next event.

P.S. I'm always up for a conversation about the future of sports, entertainment, and commercial leadership. Just hit reply or connect with me on LinkedIn.